The effects of mergers and acquisitions on firm performance.

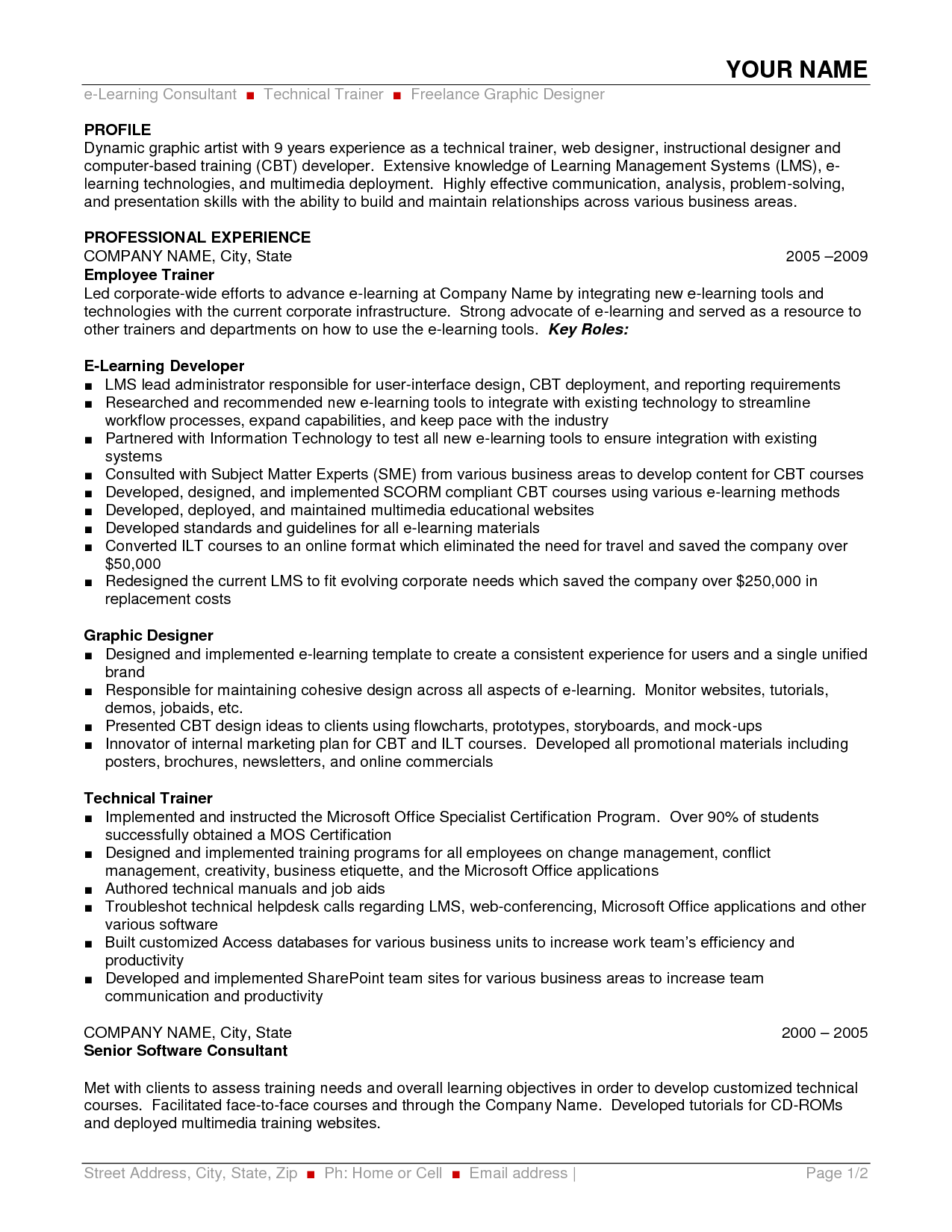

This dissertation is a study on the objectives of mergers and acquisitions, as to why organisations undertake the inorganic mode of expansion. However the main focus is on studying the operating performance and shareholder value of acquiring companies and comparing their performance before and after the merger. To conduct a uniform research and arrive at an accurate conclusion, we restrict our.

Impact of Mergers and Acquisitions announcement on shareholder value An empirical evidence of short-term performance from Singapore market. by UoN User September 2013 Word count:15,213 A Dissertation presented in part consideration for the degree of MSc Finance and Investment.

In this thesis, I reviewed the past mergers and acquisitions in China, calculated the acquirer post mergers short and long run performances, indentified the factors related to the performances, and discussed the possible reasons of these factors. Firstly, I reviewed past literature of mergers and acquisition. Especially, the Chinese merger and acquisition activity, including three subgroups.

A solid dissertation on mergers and acquisitions depends on a good topic you can write and research thoroughly. If you have the option to select a topic, think about it from different angles. Choose an angle you will be comfortable writing content and have the ability to research it without concerns. The topic idea will lead to a thesis.

Mergers and Acquisitions Edinburgh Business School ix Preface An understanding of mergers and acquisitions as a discipline is increasingly im-portant in modern business. A glance at any business newspaper or business news web page will indicate that mergers and acquisitions are big business and are taking place all the time. Some sectors, such.

Mergers and acquisitions count among the most spectacular and most obvious strategic demonstrations on the scale of the company. Globalisation has led company to think globally and act locally. Such a change in the business world have made emerge the need to.

Chinese Mergers and Acquisitions: Performance and Factors By Jia LIU ABSTRACT In this thesis, I reviewed the past mergers and acquisitions in China, calculated the acquirer post mergers short and long run performances, indentified the factors related to the performances, and discussed the possible reasons of these factors. Firstly, I.

Academia.edu is a platform for academics to share research papers.

Consider as you write your dissertation focusing on one of those ideas for your argument. Gaining a full understanding of the infrastructure of a merger or an acquisition makes you a desirable candidate to any employee. Not understanding the concepts and functionality of mergers and acquisitions could be disastrous. Mergers.

Mergers And Acquisitions. The value of mergers and acquisitions remain a topical issue within the contemporary business world. Whether these activities are beneficial to the economy or are simply meant to stifle competition is open to debate.

Essay on self assessment gateway login ielts essay cities book pdf download (about volleyball essay kabaddi in english) about shakespeare essay earthquake in english adventure life essay examples for and against essay uniform quotations best uk essay writers writing websites (environment ielts essay examples pdf) essay about communication.

CHAPTER 2: LITERATURE REVIEW 2.1 DEFINITION OF MERGERS AND ACQUISITIONS In the 21st century corporate world, mergers and acquisitions has always been one of the very important strategic tool used to achieve specific business objectives (Sudarsanam, 2003). Merger and acquisitions happens when two.

Keywords: Market efficiency, Mergers, Acquisitions, Shareholders, Banks, Information 1. Profitability Analysis of Mergers and Acquisitions Mergers and acquisitions around the globe represent a huge reallocation of resources, within and across countries and therefore, it has been the interest of empirical studies for many years.